UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Schedule 14A

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☑ |

||||

|

Filed by a party other than the Registrant ☐ |

| Check the appropriate box: |

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement – 2023 Annual Meeting of Stockholders |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

|

NATURAL HEALTH TRENDS CORP. |

||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

|

|

||||

|

Payment of Filing Fee (Check the appropriate box): |

| ☑ | No fee required |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NATURAL HEALTH TRENDS CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2023

To the Stockholders of Natural Health Trends Corp.:

The 2023 annual meeting of stockholders of Natural Health Trends Corp. (the “Company”) will be held on May 16, 2023, beginning at 9:00 a.m. local time, at the Company's office located at 19745 Colima Rd., Suite 8, Rowland Heights, CA 91748. At the meeting, the holders of the Company’s outstanding common stock will act on the following matters:

|

• |

Election of four (4) directors to the Board of Directors of the Company to serve until the next annual meeting of the Company’s stockholders |

|

• |

Ratification of the appointment of Marcum LLP as independent registered public accounting firm for the Company for the year ending December 31, 2023 |

All holders of record of shares of the Company’s common stock at the close of business on March 20, 2023 are entitled to vote at the meeting and any postponements or adjournments of the meeting.

We are using Securities and Exchange Commission rules that allow the Company to furnish proxy materials on the Internet to stockholders of the Company. Consequently, stockholders will not automatically receive paper copies of our proxy materials. We are instead sending to stockholders a Notice of Availability of Proxy Materials with instructions for accessing the proxy materials, including our proxy statement and Annual Report on Form 10-K, and for voting via the Internet. The electronic delivery of our proxy materials will reduce our printing and mailing costs and any environmental impact.

The Notice of Availability of Proxy Materials identifies the date, time and location of the annual meeting; the matters to be acted upon at the meeting and the Board of Directors’ recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where shareholders can request a paper or e-mail copy of our proxy materials, including our Annual Report on Form 10-K, proxy statement and a proxy card, free of charge.

We currently intend to hold our annual meeting in person. However, we are monitoring the coronavirus (COVID-19) situation and it may become necessary or advisable to change the date, time, location and/or means of holding the annual meeting (including by means of remote communication). Any such change will be announced via press release and website posting, as well as the filing of additional proxy materials with the Securities and Exchange Commission.

|

|

By Order Of The Board Of Directors, |

|

|

/s/ Timothy S. Davidson |

|

April 3, 2023 |

Timothy S. Davidson |

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE EXERCISE YOUR VOTING RIGHTS. THE PROXY STATEMENT IS FIRST BEING SENT OR GIVEN TO THE COMPANY’S STOCKHOLDERS ON OR ABOUT APRIL 3, 2023.

TABLE OF CONTENTS

|

|

Page |

|

ABOUT THE MEETING |

1 |

|

What is the purpose of the meeting? |

1 |

|

Who is entitled to vote at the meeting? |

1 |

|

What are the voting rights of the holders of the Company’s common stock? |

1 |

|

Who can attend the meeting and where is it being held? |

1 |

|

Why did I initially receive a Notice of Availability of Proxy Materials instead of a full set of proxy materials? |

1 |

|

How can I elect the manner in which I will receive proxy materials in the future? |

1 |

|

How do I vote? |

2 |

|

How may my broker, bank or other agent vote my shares if I fail to provide timely directions? |

2 |

|

Can I change my vote or revoke my proxy? |

2 |

|

What constitutes a quorum? |

2 |

|

What are the Board of Directors’ recommendations? |

3 |

|

What vote is required to approve each item? |

3 |

|

What types of expenses will the Company incur? |

3 |

|

|

|

|

STOCK OWNERSHIP |

4 |

|

Who are the owners of the Company’s stock? |

4 |

|

Were there any delinquent Section 16(a) reports during 2022? |

5 |

|

|

|

|

GOVERNANCE OF THE COMPANY |

5 |

|

Who are the current members of the Board of Directors and on which committees do they serve? |

5 |

|

Who is the Chairman of the Board of Directors? |

5 |

|

Which directors are considered independent? |

5 |

|

How often did the Board of Directors meet during fiscal 2022? |

6 |

|

What is the role of the Board of Directors’ Audit, Compensation, and Nominating and Corporate Governance Committees? |

6 |

| What is the composition of the Board of Directors? | 7 |

|

What is the Board of Directors’ role in risk oversight? |

7 |

|

How are directors compensated? |

8 |

|

How do stockholders communicate with the Board of Directors? |

8 |

|

Are Company employees or directors permitted to engage in hedging transactions? |

8 |

|

Does the Company have a Code of Ethics? |

8 |

|

|

|

|

INFORMATION ABOUT EXECUTIVE OFFICERS |

9 |

|

|

|

|

REPORT OF THE AUDIT COMMITTEE |

10 |

|

|

|

|

EQUITY COMPENSATION PLAN INFORMATION |

11 |

|

|

|

|

COMPENSATION OF NAMED EXECUTIVE OFFICERS AND DIRECTORS |

11 |

|

Summary Named Executive Officer Compensation Information |

11 |

|

Named Executive Officer Compensation Arrangements |

12 |

|

Pay Versus Performance Information |

12 |

|

Severance and Post-Termination Payment Arrangements |

14 |

|

Director Compensation |

15 |

|

|

|

|

ITEM ONE: ELECTION OF DIRECTORS |

16 |

|

Biographical Summaries of Nominees for the Board of Directors |

16 |

|

|

|

|

ITEM TWO: RATIFICATION OF THE APPOINTMENT OF MARCUM LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2023 |

17 |

|

Audit and Other Professional Fees |

17 |

|

Pre-Approval Policies and Procedures for Audit and Non-Audit Services |

17 |

|

|

|

|

OTHER MATTERS |

18 |

|

|

|

|

ADDITIONAL INFORMATION |

18 |

|

Stockholder Proposals for the 2024 Annual Meeting of Stockholders |

18 |

|

|

|

|

HOUSEHOLDING INFORMATION |

18 |

NATURAL HEALTH TRENDS CORP.

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of stockholders of Natural Health Trends Corp. (“the Company”) to be held on May 16, 2023 beginning at 9:00 a.m. local time, at the Company's office located at 19745 Colima Rd., Suite 8, Rowland Heights, CA 91748, and at any postponements or adjournments thereof. This proxy statement is first being made available to stockholders on or about April 3, 2023.

ABOUT THE MEETING

What is the purpose of the meeting?

At the annual meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders included with this proxy statement.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on March 20, 2023, the record date for the meeting, are entitled to receive notice of and to participate in the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or any postponements or adjournments of the meeting.

What are the voting rights of the holders of the Company’s common stock?

Each outstanding share of the Company’s common stock will be entitled to one vote on each matter considered at the meeting. Cumulative voting in the election of directors is prohibited by the Company’s certificate of incorporation.

Who can attend the meeting and where is it being held?

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting. The meeting is being held at the location identified above. To obtain directions to attend the meeting in person, please contact the Company at +852-3107-0800.

We currently intend to hold our annual meeting in person. However, we are monitoring the coronavirus (COVID-19) situation and it may become necessary or advisable to change the date, time, location and/or means of holding the annual meeting (including by means of remote communication). Any such change will be announced via press release and website posting, as well as the filing of additional proxy materials with the Securities and Exchange Commission.

Why did I initially receive a Notice of Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy materials over the Internet to our stockholders. Accordingly, a Notice of Availability of Proxy Materials was or will be sent to many of our stockholders providing notice of the annual meeting and enabling stockholders to access our proxy materials on the website referred to in the Notice of Availability of Proxy Materials (“Notice of Availability of Proxy Materials”) or request to receive free of charge a printed set of the proxy materials, including the Notice of Annual Meeting, our 2022 Annual Report on Form 10-K, this proxy statement and a proxy card. Instructions on how to access the proxy materials over the Internet or to request a printed copy are set out in the Notice of Availability of Proxy Materials. Those stockholders that previously requested to receive our proxy materials in printed or electronic form will receive such proxy materials in lieu of the Notice of Availability of Proxy Materials.

How can I elect the manner in which I will receive proxy materials in the future?

All stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis by following the instructions in the Notice of Availability of Proxy Materials. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet in order to help reduce printing and mailing costs and any environmental impact.

How do I vote?

|

By Mail: |

If you complete and properly sign the accompanying form of proxy card and return it to the indicated address, it will be voted as you direct. |

|

In Person: |

If you are a registered stockholder and attend the meeting, you may vote in person at the meeting. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must obtain a valid legal proxy from your broker, bank or other agent to vote in person at the meeting. |

| Via Internet: | Log on to http://www.proxyvote.com and follow the on-screen instructions. |

Note: Please also refer to the specific instructions set forth in the Notice of Availability of Proxy Materials or, if you requested to receive our proxy materials in printed or electronic form, in the proxy materials.

How may my broker, bank or other agent vote my shares if I fail to provide timely directions?

Brokers, banks or other agents holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other agent will have discretion to vote your shares on the “routine” matters to be voted upon at the meeting — the proposal to ratify the appointment of Marcum LLP (Item Two). Your broker does not have discretion to vote on the election of directors (Item One) absent direction from you.

Can I change my vote or revoke my proxy?

Yes. You can change your vote or revoke your proxy. If you are a registered stockholder, you may revoke your proxy in any one of four ways.

|

• |

You may send a written notice that you are revoking your proxy to the Company's Corporate Secretary at the Company’s principal executive offices located at Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong, Attention: Timothy S. Davidson. |

|

• |

You may timely grant another proxy via the Internet. |

|

• |

You may submit another properly completed proxy card with a later date. |

|

• |

You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy. |

Your most current proxy, whether submitted by proxy card, via the Internet or in person, is the one that is counted.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the aggregate voting power of the stock outstanding on the record date will constitute a quorum, permitting the stockholders to act upon the matters outlined in the Notice of Annual Meeting of Stockholders. As of the record date, 11,520,439 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of the holders of common stock representing at least 5,760,220 shares of common stock will be required to establish a quorum.

A proxy submitted by a stockholder may indicate that all or a portion of the shares represented by the proxy are not being voted (“stockholder withholding”) with respect to a particular matter. Similarly, a broker may not be permitted to vote stock (“broker non-vote”) held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock. See above under the caption “How may my broker, bank or other agent vote my shares if I fail to provide timely directions?” The shares subject to a proxy that are not being voted on a particular matter because of either stockholder withholding or broker non-vote will count for purposes of determining the presence of a quorum. Abstentions are also counted in the determination of a quorum.

What are the Board of Directors’ recommendations?

Unless you give other instructions on your returned proxy, the persons named as proxy holders on the proxy will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are set forth together with the description of each item in this proxy statement. In summary, the Board of Directors recommends a vote:

|

• |

for election of the nominated slate of Directors (see Item One); |

|

• |

for ratification of the appointment of Marcum LLP as independent registered public accounting firm for the Company for the year ending December 31, 2023 (see Item Two). |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

Election of Directors. The affirmative vote of a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors at the meeting (Item One). You may vote “for” or “withhold” on each of the nominees for election as a director. Any shares not voted “for” a particular nominee (whether as a result of “withhold” votes or broker non-votes) will not be counted in such nominee’s favor and will have no direct effect on the outcome of the election.

Ratification of Independent Registered Public Accounting Firm. For the ratification of the appointment of Marcum LLP as independent registered public accounting firm for the Company for the year ending December 31, 2023 (Item Two), the affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy and entitled to vote at the meeting will be required for approval. You may vote “for,” “against” or “abstain” on this proposal. Abstentions and broker non-votes (to the extent applicable) are not considered “votes cast” on this item, and thus will not directly affect the outcome of the vote for this item.

What types of expenses will the Company incur?

The expense of preparing, printing and mailing proxy materials and the Notice of Availability of Proxy Materials, as well as all expenses of soliciting proxies, will be borne by the Company. In addition to the use of the mails, proxies may be solicited by officers and directors and regular employees of the Company, without additional remuneration, by personal interaction, telephone, telegraph or facsimile transmission. The Company may elect to engage a proxy solicitation firm to solicit stockholders to vote or grant a proxy with respect to the proposals contained in this proxy statement. The Company will request brokers, banks, nominees, custodians, fiduciaries and other agents to forward proxy materials to the beneficial owners of shares of common stock held of record and will provide reimbursements for the cost of forwarding the material in accordance with customary charges.

STOCK OWNERSHIP

Who are the owners of the Company’s stock?

The following table shows the amount of the Company’s common stock beneficially owned (unless otherwise indicated) as of March 20, 2023 by (i) each stockholder known to us to be the beneficial owner of more than 5% of the Company’s common stock, (ii) each director or director nominee, (iii) each of the Company’s named executive officers and (iv) all executive officers and directors as a group. Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission and generally includes those persons who have voting or investment power with respect to the securities. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of the Company’s common stock beneficially owned by them.

|

Name and Address of Beneficial Owner (1) |

|

Amount and Nature of Beneficial Ownership (2) |

|

Percent of Class (2) |

||

|

Executive Officers and Directors: |

|

|

|

|

||

|

Chris T. Sharng |

|

886,645 |

|

7.7 |

% |

|

|

Timothy S. Davidson |

|

391,100 |

|

3.4 |

% |

|

|

Yiu T. Chan |

|

— |

|

— |

||

|

Randall A. Mason |

|

252,733 |

(3) |

2.2 |

% | |

|

Ching C. Wong |

|

— |

|

— |

|

|

|

All executive officers and directors as a group (5 persons) |

|

1,530,478 |

|

13.3 |

% |

|

|

Non-Executive Stockholders Beneficially Owning 5% or More: |

|

|

|

|

||

|

Eleanor Jane Broady 2012 Irrevocable Trust |

|

2,245,128 |

(4) |

19.5 |

% |

|

|

Renaissance Technologies LLC |

|

717,982 |

(5) |

6.2 |

% |

|

| George K. Broady 2012 Irrevocable Trust | 690,099 | (6) | 6.0 | % | ||

_______________________

|

(1) |

Unless otherwise indicated, the address of each beneficial owner is c/o Natural Health Trends Corp., Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong. |

|

(2) |

Any securities not outstanding that are subject to conversion privileges exercisable within 60 days of March 20, 2023 are deemed outstanding for the purpose of computing the percentage of outstanding securities of the class owned by any person holding such securities, but are not deemed outstanding for the purpose of computing the percentage of the class owned by any other person in accordance with Item 403 of Regulation S-K promulgated under the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) and Rule 13d-3 of the Exchange Act, and based upon 11,520,439 shares of common stock outstanding as of March 20, 2023. |

|

(3) |

Includes 23,899 shares owned by Marden Rehabilitation Associates, Inc., an entity controlled by Mr. Mason. |

|

(4) |

Eleanor Jane Broady, the spouse of George K. Broady, is the sole current beneficiary of the Eleanor Jane Broady 2012 Irrevocable Trust. The Eleanor Jane Broady 2012 Irrevocable Trust pledged 2,129,610 shares to secure a line of credit. The Company understands that the Eleanor Jane Broady 2012 Irrevocable Trust has five co-trustees (and the co-trustees must act jointly through a majority in order to take action under the terms of the trust, including the exercise of voting or investment powers with respect to the Company’s common stock held by the trust). |

|

(5) |

The information regarding the beneficial ownership of Renaissance Technologies LLC (“RTC”) is based on the Schedule 13G filed jointly with Renaissance Technologies Holdings Corporation (“RTHC”) with the Securities and Exchange Commission on February 13, 2023. According to this Schedule 13G, RTHC owns a majority of RTC and therefore each of RTC and RTHC is deemed to have sole voting and dispositive power over all 717,982 common shares. The address for each of RTC and RTHC is 800 Third Avenue, New York, New York 10022. |

|

| (6) | George K. Broady, a former director of the Company, is the current trustee and a beneficiary of the George K. Broady 2012 Irrevocable Trust. The George K. Broady 2012 Irrevocable Trust pledged 570,390 shares to secure a line of credit. The Company understands that five individuals are currently named successor co-trustees to the George K. Broady 2012 Irrevocable Trust (and that in the event such successor co-trustees commence serving as co-trustees, they must act jointly through a majority in order to take action under the terms of the trust, including the exercise of voting or investment powers with respect to the Company’s common stock held by the trust); provided, that it is further understood that Mr. Broady could elect at any time to change the designation of successor co-trustees to the trust. |

Were there any delinquent Section 16(a) reports during 2022?

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. To the Company’s knowledge, based solely on its review of electronic filings with the Securities and Exchange Commission and any written representations received by the Company from persons required to make filings under Section 16(a), all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were satisfied, except that Ms. Brunde Broady and Messrs. Mason, Chan, Wong, Sharng and Davidson each filed one Form 4 reporting one transaction late. Ms. Broady was a member of the Board of Directors until her resignation on February 6, 2023.

GOVERNANCE OF THE COMPANY

Who are the current members of the Board of Directors and on which committees do they serve?

The members of the Board of Directors on the date of this proxy statement and the committees of the Board of Directors on which they serve are identified below.

|

Director |

|

Age |

|

Audit Committee |

|

Compensation Committee |

|

Nominating and Corporate Governance Committee |

|

Yiu T. Chan |

|

56 |

|

M |

|

C |

|

M |

| Randall A. Mason | 64 | C | — | M | ||||

|

Ching C. Wong |

|

64 |

|

M |

|

M |

|

C |

|

Chris T. Sharng |

|

59 |

|

— |

|

— |

|

— |

M = Member

C = Chair

Who is the Chairman of the Board of Directors?

Mr. Mason has served as Chairman of the Board of Directors since March 2006. The Chairman of the Board of Directors organizes the work of the Board of Directors and ensures that the Board of Directors has access to sufficient information to enable the Board of Directors to carry out its functions, including monitoring the Company’s performance and the performance of management. In carrying out this role, the Chairman, among other things, presides over all meetings of the Board of Directors, establishes the annual agenda of the Board of Directors, established the agendas of each meeting in consultation with the President, and oversees the distribution of information to directors.

Which directors are considered independent?

The Board of Directors has adopted the requirements in Nasdaq Marketplace Rule 5605(a)(2) as its standard in determining the “independence” of members of its Board of Directors. The Board of Directors has determined that each of the following individuals who are nominated for election as a director qualifies as an “independent director” under this standard:

Yiu T. Chan

Randall A. Mason

Ching C. Wong

Subject to applicable exemptions, the Company applies the foregoing Nasdaq standard for determining the “independence” of each member of its Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The Board of Directors has determined that all of the members of each such Committee qualifies as “independent.” Further, the Board of Directors has separately determined that each member of the Audit Committee meets the criteria for independence set forth in Rule 10A-3(b)(1) promulgated under the Exchange Act, as required for service on the Audit Committee.

How often did the Board of Directors meet during fiscal 2022?

The Board of Directors met or acted by unanimous written consent a total of 11 times during the fiscal year ended December 31, 2022, and each director attended at least seventy-five percent (75%) of these meetings. As described below, the Company’s Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each met or acted by unanimous written consent a number of times during the fiscal year ended December 31, 2022, and the members of each such committee attended at least seventy-five percent (75%) of such committee meetings.

What is the role of the Board of Directors’ Audit, Compensation, and Nominating and Corporate Governance Committees?

Audit Committee. Mr. Mason serves as Chairman of the Audit Committee, and Messrs. Chan and Wong also serve as members of the Audit Committee. The Board of Directors has determined that each of Messrs. Mason, Chan and Wong is independent and satisfies the other criteria set forth in the Nasdaq Marketplace Rules for service on the Audit Committee. The Board of Directors has also determined that each of Messrs. Mason, Chan and Wong meets the Securities and Exchange Commission criteria of an “audit committee financial expert” and that each also meets the requirements of Nasdaq Marketplace Rule 5605 relating to financial oversight responsibility. The Audit Committee is required to meet in person or telephonically at least four times a year. The Audit Committee met or acted by unanimous written consent a total of six times during the fiscal year ended December 31, 2022.

The functions of the Audit Committee are set forth in the Audit Committee Charter as approved by the Board of Directors and as posted on our website at www.naturalhealthtrendscorp.com. In general, these responsibilities include meeting with the internal financial staff of the Company and the independent registered public accounting firm engaged by the Company to review (i) the scope and findings of the annual audit, (ii) quarterly financial statements, (iii) accounting policies and procedures and (iv) the internal controls employed by the Company. The Audit Committee is also directly and solely responsible for the appointment, retention, compensation, oversight and termination of the Company’s independent registered public accounting firm. The Audit Committee’s findings and recommendations are reported to management and the Board of Directors for appropriate action.

Compensation Committee. The Compensation Committee operates pursuant to a charter approved by the Board of Directors, a copy of which is posted on our website at www.naturalhealthtrendscorp.com. The members of our Compensation Committee are Messrs. Chan and Wong, with Mr. Chan serving as Chairman of the Compensation Committee. Each of the members of the Compensation Committee qualifies as an “independent director” within the meaning of the Nasdaq Marketplace Rules. The Compensation Committee is charged with responsibility to oversee our compensation policies and programs, including developing compensation, providing oversight of the implementation of the policies, and specifically addressing the compensation of our executive officers and directors, including the negotiation of employment agreements with executive officers. The Compensation Committee is not authorized to delegate to another body or person any of its responsibilities (other than to a subcommittee of the Compensation Committee), although it may seek compensation-related input from the Company’s management, other directors, consultants and other third parties. The Compensation Committee considers all elements of executive compensation together and utilizes the members’ experience and judgment in determining the total compensation opportunity and mix of compensation elements appropriate for each executive officer in light of the Company’s compensation objectives. The Compensation Committee periodically consults with our President, who makes recommendations to the Compensation Committee regarding compensation of our key employees, including that of our executive officers. Our President makes recommendations to the Compensation Committee regarding base salaries, and may recommend that the incentive compensation otherwise payable to an employee under the Company’s Sales Incentive Plan, Annual Incentive Plan or 2014 Long-Term Incentive Plan be increased or decreased. Notwithstanding the President’s participation in some of the Compensation Committee’s activities, all compensation determinations are made by the Compensation Committee. The Compensation Committee also annually evaluates compensation to be awarded to each of its non-employee directors, with a focus on monthly cash retainer payment arrangements, as well as whether annual performance justifies the award of discretionary cash or equity bonuses. The Compensation Committee met or acted by unanimous written consent a total of six times during the fiscal year ended December 31, 2022.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee (the “Nominating Committee”) operates pursuant to a charter approved by our Board of Directors, a copy of which is posted on our website at www.naturalhealthtrendscorp.com. The members of the Nominating Committee are Messrs. Mason, Wong and Chan, with Mr. Wong serving as Chairman of the Nominating Committee. Each of the members of the Nominating Committee qualifies as an “independent director” within the meaning of the Nasdaq Marketplace Rules. The Nominating Committee considers and makes recommendations to the Board of Directors with respect to the size and composition of the Board of Directors and identifies potential candidates to serve as directors. The Nominating Committee identifies candidates to the Board of Directors by introduction from management, members of the Board of Directors, employees or other sources and stockholders that satisfy the Company’s policy and Bylaw provisions regarding stockholder recommended candidates. The Nominating Committee does not evaluate director candidates recommended by stockholders differently than director candidates recommended by other sources. The Nominating Committee met or acted by unanimous written consent one time during the fiscal year ended December 31, 2022.

A stockholder wishing to nominate an individual for election to the Board of Directors or to otherwise submit a candidate for consideration by the Nominating Committee must comply with the advance notice provisions set forth in our Bylaws, which are generally described in this proxy statement under the caption “Additional Information—Stockholder Proposals for the 2024 Annual Meeting of Stockholders.” These provisions require the timely submission of information concerning the nominee or candidate, as well as information as to the stockholder’s ownership of our common stock.

In considering Board of Director candidates, the Nominating Committee takes into consideration the Company’s “New Director Candidates” factors (as set forth in the charter of the Nominating Committee), the Company’s policy regarding stockholder-recommended director candidates as set forth above, selection criteria recommended by stockholders, and all other factors that they deem appropriate, including, but not limited to, the individual’s judgment, skill, integrity, and experience with businesses and other organizations of comparable size, industry knowledge, the interplay of the candidates experience with the experience of the existing members of the Board of Directors, the number of other public and private company boards on which the candidate serves and diversity, of age, gender, ethnicity, and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company to maintain a balance of knowledge, experience, background, and capability. At this time, the Nominating Committee does not have a specific process for assessing the effectiveness of its consideration of diversity in director candidates, but believes that the diversity reflected in the composition of its Board of Directors is appropriate given the nature of the Company’s business. For each new or vacant position on the Board of Directors, the charter of the Nominating Committee provides that the Nominating Committee shall ensure that a diverse slate of candidates is identified and evaluated. In evaluating whether an incumbent director should be nominated for re-election to the Board of Directors, the Nominating Committee takes into consideration the same factors established for other director candidates and also takes into account the incumbent director’s performance as a member of the Board of Directors.

The Nominating Committee did not receive, on or prior to the applicable annual deadline, a candidate recommendation from any stockholder (or group of stockholders) that beneficially owns more than five percent of the Company’s common stock.

What is the composition of the Board of Directors?

As described above, the Nominating Committee takes diversity considerations into account when evaluating Board of Director candidates. Recently adopted Nasdaq Rule 5605(f) requires each listed company that has five or fewer board members to have, or explain why it does not have, at least one diverse director on the board. Inasmuch as our current Board of Directors includes a number of diverse directors within the meaning of the Nasdaq Rule, the composition of our Board of Directors is in compliance with the Nasdaq diversity requirement. The table below highlights certain features of the composition of our Board of Directors. Each of the categories listed in the below table has the meaning used in Nasdaq Rule 5605(f).

BOARD DIVERSITY MATRIX

(As of April 3, 2023)

| Total number of directors | 4 | |||||||

|

|

Female |

|

Male |

|

Non-Binary |

|

Did Not Disclose Gender |

|

|

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

Directors |

|

— |

|

4 |

|

— |

|

— |

|

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

African American or Black |

|

— |

|

— |

|

— |

|

— |

| Alaskan Native or Native American | — | — | — | — | ||||

| Asian | — | 3 | — | — | ||||

| Hispanic or Latinx | — | — | — | — | ||||

|

Native Hawaiian or Pacific Islander |

|

— |

|

— |

|

— |

|

— |

| White | — | 1 | — | — | ||||

| Two or more races or ethnicities | — | — | — | — | ||||

| LGBTQ+ | — | |||||||

| Did not disclose demographic background | — | |||||||

What is the Board of Directors’ role in risk oversight?

Our Board of Directors has responsibility for the oversight of risks that could affect the Company. This oversight is conducted primarily through the Board of Directors with respect to significant matters, including the strategic direction of the Company, and by the various committees of the Board of Directors in accordance with their charters. The Board of Directors continually works, with the input of its committees and of the Company’s management to assess and analyze the most likely areas of future risk for the Company. Directors also have complete and open access to all of our employees and are free to, and do, communicate directly with our management. In addition to our formal compliance efforts, the Board of Directors encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations.

How are directors compensated?

Our employee director did not receive compensation for his service as director. Information with respect to the compensation of the non-employee members of our Board of Directors is set forth below under the caption “Compensation of Named Executive Officers and Directors—Director Compensation.”

How do stockholders communicate with the Board of Directors?

Stockholders or other interested parties wishing to communicate with the Board of Directors, the independent directors as a group, or any individual director may do so in writing by sending an e-mail to compliance@nhtglobal.com, or by mail to Natural Health Trends Corp. at the address of its headquarters (Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong, Attention: Timothy S. Davidson). Complaints or concerns that appear to involve Mr. Davidson may be directed to the Chairman of the Audit Committee at audit.chair@nhtglobal.com. Complaints relating to the Company’s accounting, internal accounting controls or auditing matters, and concerns regarding questionable accounting or auditing matters are referred to the Chairman of the Audit Committee. Alternatively, any such complaints or concerns may be submitted anonymously at www.lighthouse-services.com/nhtglobal. Other Board communications are referred to the Chairman of the Board of Directors, provided that advertisements, solicitations for periodical or other subscriptions, and similar communications generally are not forwarded. The Company held an annual stockholders meeting on May 10, 2022. None of the members of the Board of Directors were personally in attendance at the meeting, and the Company does not, at this time, have a policy regarding director attendance at annual stockholder meetings.

Are Company employees or directors permitted to engage in hedging transactions?

No. The Company’s Insider Trading Policy prohibits employees and directors from entering into hedging transactions or similar arrangements with respect to the Company’s stock.

Does the Company have a Code of Ethics?

The Company has a Worldwide Code of Business Conduct (the “Code”) that applies to our employees, officers (including our principal executive officer and principal financial officer) and directors. The Code is intended to establish standards necessary to deter wrongdoing and to promote compliance with applicable governmental laws, rules and regulations, and honest and ethical conduct. The Code covers many areas of professional conduct, including conflicts of interest, financial reporting and disclosure, protection of Company assets and confidentiality. Employees have an obligation to promptly report any known or suspected violation of the Code without fear of retaliation. The Company has made the Code available on its website at https://ir.naturalhealthtrendscorp.com/governance-docs. Waiver of any provision of the Code for executive officers and directors may only be granted by the Board of Directors and any such waiver or any modification of the Code relating to such individuals will be disclosed by the Company on its website at https://ir.naturalhealthtrendscorp.com.

INFORMATION ABOUT EXECUTIVE OFFICERS

Certain information concerning executive officers of the Company is set forth below:

|

Name |

|

Age |

|

Position(s) with the Company |

|

Chris T. Sharng |

|

59 |

|

President |

|

Timothy S. Davidson |

|

52 |

|

Chief Financial Officer, Senior Vice President and Corporate Secretary |

Chris T. Sharng. Mr. Sharng has served as President of the Company since February 2007, and as a director since March 2012. He served as Executive Vice President and Chief Financial Officer of the Company from August 2004 to February 2007. Mr. Sharng also performed the functions of the principal executive officer of the Company from April 2006 to August 2006. From March 2006 to August 2006, Mr. Sharng served as a member of the Company’s Executive Management Committee, which was charged with managing the Company’s day-to-day operations while a search was conducted for a new chief executive officer for the Company. From March 2004 through July 2004, Mr. Sharng was the Chief Financial Officer of NorthPole Limited, a privately held Hong Kong-based manufacturer and distributor of outdoor recreational equipment. From October 2000 through February 2004, Mr. Sharng was the Senior Vice President and Chief Financial Officer of Ultrak Inc., which changed its name to American Building Control Inc. in 2002, a Texas-based, publicly traded company listed on The NASDAQ Stock Market that designed and manufactured security systems and products. From March 1989 through July 2000, Mr. Sharng worked at Mattel, Inc., most recently as the Vice President of International Finance. Mr. Sharng has an MBA from Columbia University and received his bachelor degree from National Taiwan University.

Timothy S. Davidson. Mr. Davidson has served as the Company’s Chief Financial Officer and Senior Vice President since February 2007, and as the Company’s Corporate Secretary since January 2014. He previously served as the Company’s Chief Accounting Officer from September 2004 to February 2007. From March 2001 to September 2004, Mr. Davidson was Corporate Controller for a telecommunications company, Celion Networks, Inc., located in Richardson, Texas. From February 2000 to February 2001, Mr. Davidson was Manager of Financial Reporting for another Dallas-based telecommunications company, IP Communications, Inc. From December 1994 through January 2000, Mr. Davidson was employed by Arthur Andersen, LLP, most recently as an Audit Manager. Mr. Davidson has a master degree in professional accounting from the University of Texas at Austin and received his bachelor degree from Texas A&M University at Commerce.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates this Report of the Audit Committee by reference therein.

We have reviewed and discussed the consolidated financial statements of the Company set forth at Item 8 in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 with management of the Company and Marcum LLP (“Marcum”).

We have discussed with Marcum the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the Securities and Exchange Commission.

We have received the written disclosures and the letter from Marcum required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and have also discussed with Marcum that firm’s independence. The Audit Committee has concluded that Marcum’s services provided to the Company are compatible with Marcum’s independence.

Based on our review and discussions with management of the Company and Marcum referred to above, we recommended to the Board of Directors that the consolidated financial statements of the Company be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s consolidated financial statements are complete and accurate and in accordance with accounting principles generally accepted in the United States of America; that is the responsibility of management and the Company’s independent registered public accounting firm. In giving its recommendation to the Board of Directors, the Audit Committee has relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and (ii) the reports of the Company’s independent registered public accounting firm with respect to such financial statements.

Members of the Audit Committee of the Board of Directors

Randall A. Mason (Chairman)

Yiu T. Chan

Ching C. Wong

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information regarding all compensation plans under which the Company's equity securities were authorized for issuance as of December 31, 2022:

|

Plan Category |

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

|

Weighted-average exercise price of outstanding options, warrants and rights (b) |

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

||||

|

Equity compensation plans approved by security holders |

|

— |

|

$ |

— |

|

1,219,583 |

|||

|

Equity compensation plans not approved by security holders |

|

— |

|

$ |

— |

|

— |

|||

|

Total |

|

— |

|

$ |

— |

|

1,219,583 |

|||

The foregoing securities remaining available for issuance were reserved under the Company's 2016 Equity Incentive Plan.

COMPENSATION OF NAMED EXECUTIVE OFFICERS AND DIRECTORS

Summary Named Executive Officer Compensation Information

The following table provides information concerning the compensation for the years ended December 31, 2022 and 2021 of our principal executive officer and one other executive officer (collectively, the “named executive officers”):

SUMMARY COMPENSATION TABLE

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

Bonus ($) |

Stock Awards ($)(1) |

|

All Other Compensation ($)(2) |

|

Total ($) |

|||||

|

Chris T. Sharng, President |

|

2022 |

|

1,000,000 |

|

— |

359,492 |

|

13,725 |

|

1,373,217 |

|||||

|

|

|

2021 |

|

1,000,000 |

|

— |

432,442 |

|

13,050 |

|

1,445,492 |

|||||

|

Timothy S. Davidson, Chief Financial Officer, Senior Vice President and Corporate Secretary |

|

2022 |

|

393,270 |

|

41,169 |

120,320 |

|

13,725 |

|

568,484 |

|||||

|

|

|

2021 |

|

350,000 |

|

32,000 |

144,757 |

|

13,050 |

|

539,807 |

|||||

_______________________

| (1) | The amounts in this column represent the aggregate grant date fair value of phantom shares granted to the named executive officers under the Company’s Phantom Equity Plan, as computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation – Stock Compensation, excluding estimated forfeitures. Assumptions used in the calculation of phantom share awards are included in Note 9 of the Notes to Consolidated Financial Statements under “Item 8. Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2022. |

|

(2) |

The amounts in this column represent employer matching contributions under the Company’s defined contribution plan. |

Named Executive Officer Compensation Arrangements

Chris T. Sharng. The Company is a party to an employment agreement with Mr. Sharng that provides for a base annual salary and also provides that Mr. Sharng is eligible or entitled to participate in our incentive plans (including our equity incentive plans) and other standard U.S. employee benefit programs. Mr. Sharng was paid a base annual salary of $1,000,000 in each of 2022 and 2021. On March 15, 2021, the Compensation Committee granted 124,850 phantom shares to Mr. Sharng under the Company’s Phantom Equity Plan (the “Phantom Equity Plan”). The phantom shares entitled Mr. Sharng to receive a cash payment equal to the fair market value of an equal number of shares of the Company’s common stock upon the close of a vesting period, subject to a maximum payment value of $12.00 per phantom share. The phantom shares vested in eight equal three-month vesting increments, subject to the satisfaction of both a time-based vesting condition and a performance vesting condition. Both of these vesting conditions were deemed satisfied on the grant date for the initial vesting increment, and were satisfied for each of the following three performance periods in 2021 and the first performance period in 2022. The time-based vesting condition was also satisfied for the final three performance periods in 2022. The award agreement under which the phantom shares were awarded to Mr. Sharng was amended for each of the final three performance periods in 2022 to provide that the performance criteria for the related vesting condition shall be deemed satisfied, as the Compensation Committee noted that the fact that the performance criteria were not achieved for the relevant performance periods was due to extraordinary business circumstances in China that were clearly beyond the Company’s control. Awards of aggregate fair value of $359,492 and $432,442 were made to Mr. Sharng under the Phantom Equity Plan for each of 2022 and 2021, respectively, and the phantom shares granted to Mr. Sharng on March 15, 2021 are now fully vested. Neither Mr. Sharng nor any other Company employee was designated by the Compensation Committee to participate in the Company’s Annual Incentive Plan (“Annual Plan”) or 2014 Long-Term Incentive Plan (the “Long-Term Plan”) in 2022 or 2021. Mr. Sharng serves on the Company’s Board of Directors, but does not receive any additional compensation for his service in that capacity.

Timothy S. Davidson. The Company is a party to an employment agreement with Mr. Davidson that provides for a base annual salary and also provides that Mr. Davidson is eligible or entitled to participate in our incentive plans (including our equity incentive plans) and other standard U.S. employee benefit programs. Mr. Davidson was paid a base annual salary of $350,000 in 2021. Mr. Davidson's base annual salary was raised to $400,000 effective February 7, 2022. The Compensation Committee awarded discretionary cash bonuses to Mr. Davidson in 2022 of $16,800 as a quarantine allowance and $24,369 as a special project stipend. The Compensation Committee awarded a discretionary cash bonus of $32,000 to Mr. Davidson in 2021 based on his strong annual performance during that year. On March 15, 2021, the Compensation Committee granted 41,788 phantom shares to Mr. Davidson under the Phantom Equity Plan. The phantom shares entitled Mr. Davidson to receive a cash payment equal to the fair market value of an equal number of shares of the Company’s common stock upon the close of a vesting period, subject to a maximum payment value of $12.00 per phantom share. The phantom shares vested in eight equal three-month vesting increments, subject to the satisfaction of both a time-based vesting condition and a performance vesting condition. Both of these vesting conditions were deemed satisfied on the grant date for the initial vesting increment, and were satisfied for each of the following three performance periods in 2021 and the first performance period in 2022. The time-based vesting condition was also satisfied for the final three performance periods in 2022. The award agreement under which the phantom shares were awarded to Mr. Davidson was amended for each of the final three performance periods in 2022 to provide that the performance criteria for the related vesting condition shall be deemed satisfied, as the Compensation Committee noted that the fact that the performance criteria were not achieved for the relevant performance periods was due to extraordinary business circumstances in China that were clearly beyond the Company’s control. Awards of aggregate fair value of $120,320 and $144,757 were made to Mr. Davidson under the Phantom Equity Plan for each of 2022 and 2021, respectively, and the phantom shares granted to Mr. Davidson on March 15, 2021 are now fully vested. Neither Mr. Davidson nor any other Company employee was designated by the Compensation Committee to participate in the Annual Plan or Long-Term Plan in 2022 or 2021.

Pay Versus Performance Information

Pay Versus Performance Table. The following table provides information for the years ending December 31, 2022 and 2021 concerning the total compensation of the Company’s principal executive officer (“PEO”) and its one other “named executive officer,” as well as certain other comparative data.

|

Year |

|

Summary Compensation Table Total for PEO ($)(1) |

|

Compensation Actually Paid to PEO ($)(2) |

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officer ($)(1) |

Average Compensation Actually Paid to Non-PEO Named Executive Officer ($)(2) |

|

Value of Initial Fixed $100 Investment Based on Total Shareholder Return (TSR) ($)(3) |

|

Company's Net Income ($ in thousands)(4) |

|||||

|

2022 |

|

1,373,217 |

|

1,321,430 |

|

568,484 |

550,470 |

|

96.35 |

|

313 |

|||||

|

2021 |

|

1,445,492 |

|

1,968,162 |

|

539,807 |

741,936 |

|

153.97 |

|

1,085 |

|||||

_______________________

|

(1) |

Chris T. Sharng served as the Company’s PEO during each of the covered fiscal years, and Timothy S. Davidson served as the Company’s Chief Financial Officer, Senior Vice President and Corporate Secretary, and sole other “named executive officer,” during each of the reported years. |

|

| (2) | SEC rules require certain adjustments to be made to the Summary Compensation Table totals to determine “compensation actually paid” as reported in the “pay versus performance” table above. In accordance with SEC rules, the following adjustments were made to derive the “compensation actually paid” to the Company’s PEO and Non-PEO named executive officer. |

|

Year |

|

Summary Compensation Table Total for PEO ($) |

|

Value of Stock Awards ($)(a) |

|

Change in Value of Unvested Awards Granted in Prior Years ($) |

Change in Value of Awards Granted in Prior Years That Vested During the Year ($) |

Value of Awards Granted and Vested During the Year ($) |

|

Dividends on Unvested Awards Paid During the Year ($) |

|

Compensation Actually Paid to PEO ($) |

||||||

|

2022 |

|

1,373,217 |

|

(359,492) |

|

— |

(34,345) | 321,647 |

|

20,403 |

|

1,321,430 |

||||||

|

2021 |

|

1,445,492 |

|

(432,442) |

|

125,820 |

— | 706,871 |

|

122,421 |

|

1,968,162 |

||||||

| (a) | Represents the aggregate grant date fair value of phantom shares as reported in the “Stock Awards” column in the Summary Compensation Table for the applicable year. |

|

Year |

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officer ($) |

|

Value of Stock Awards ($) |

|

Change in Value of Unvested Awards Granted in Prior Years ($) |

Change in Value of Awards Granted in Prior Years That Vested During the Year ($) |

Value of Awards Granted and Vested During the Year ($) |

|

Dividends on Unvested Awards Paid During the Year ($) |

|

Average Compensation Actually Paid to Non-PEO Named Executive Officer ($) |

||||||

|

2022 |

|

568,484 |

|

(120,320) |

|

— |

(13,173) | 107,652 |

|

7,827 |

|

550,470 |

||||||

|

2021 |

|

539,807 |

|

(144,757) |

|

48,272 |

— | 251,327 |

|

47,287 |

|

741,936 |

||||||

|

(3) |

TSR is determined based on the value of an initial fixed investment of $100 in the Company's common stock on December 31, 2020, assuming the reinvestment of dividends. |

|

| (4) | The Company’s net income is derived from its financial statements for the years ended December 31, 2022 and 2021. |

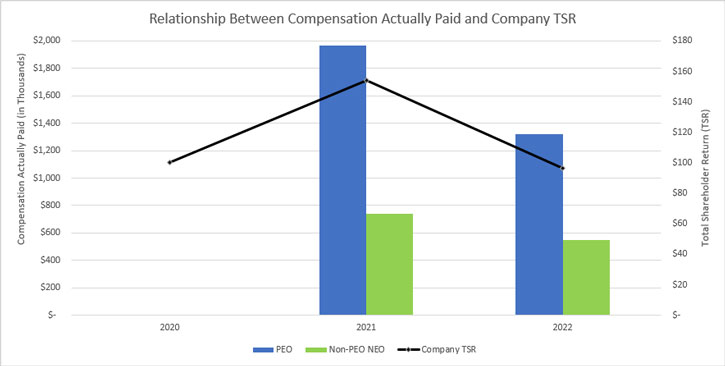

Description of Relationship Between Compensation Actually Paid and Company Total Shareholder Return (TSR). The following chart sets forth the relationship between compensation actually paid to the Company's PEO, the average compensation actually paid to the Company's Non-PEO named executive officer, and the Company's TSR over the years presented in the table (as of year end).

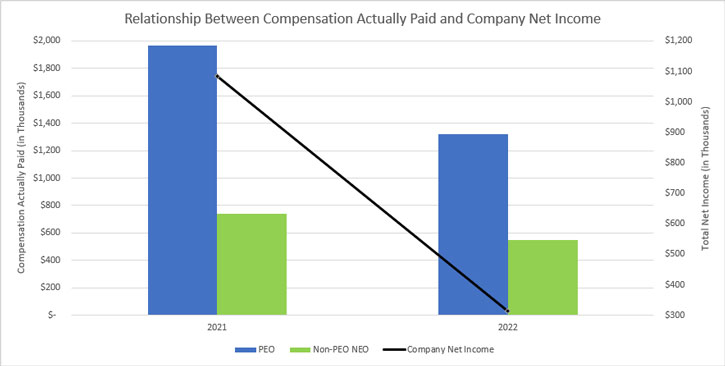

Description of Relationship Between Compensation Actually Paid and Company Net Income. The following chart sets forth the relationship between compensation actually paid to the Company's PEO, the average compensation actually paid to the Company's Non-PEO named executive officer, and the Company's net income over the years presented in the table.

Severance and Post-Termination Payment Arrangements

A primary feature of the Company’s employment agreements with its named executive officers provides compensation to the named executive officer in the event of the termination of the executive’s employment under certain circumstances. The employment agreements provide that if the executive’s employment with the Company is terminated voluntarily by him for “good reason,” or is terminated by the Company without “cause,” other than in connection with a “change of control,” then the executive will be entitled to the continuation of the payment of his salary, plus health and medical insurance coverage, for a period of up to one year following the termination date, or until the earlier date upon which he becomes engaged in any “competitive activity” (as defined in a separate non-competition agreement) or otherwise breaches the terms and conditions of such agreement. These severance provisions are intended to compensate the executive until he is able to secure another source of income. In the event the executive’s employment with the Company is terminated by the Company, or its successor in a change of control transaction, without “cause” during the period commencing on the date that is 30 days prior to a change of control through and including a date that is 18 months following the change of control, he is entitled to a payment equal to two years of his salary (plus health and medical insurance coverage costs). This payment is due in a lump sum 30 days after the termination date. These change of control features in the employment agreements are referred to as “double trigger” severance arrangements. This means that no severance compensation will become payable to a named executive officer only because of the occurrence of a change of control of the Company. Instead change of control severance compensation will only be payable if, within 30 days prior to a change of control through and including a date that is 18 months following the change of control, there is also a termination of the executive’s employment without “cause.” These change of control severance provisions are intended to (i) preserve morale and productivity and encourage retention of the executive in the face of the disruptive impact that a change of control of the Company is likely to have, and (ii) encourage the executive to remain focused on the business and interests of the Company’s stockholders when considering strategic alternatives that may be beneficial to those stockholders.

The named executive officers also participate in the Annual Plan and Long-Term Plan in some years (collectively, the “Cash Incentive Plans”). Under the terms of the Cash Incentive Plans, if a participant separates from service for any reason other than on account of a “Qualifying Termination Event,” any award granted to the participant that remains undistributed shall be immediately and irrevocably forfeited in full. A “Qualifying Termination Event” is defined under the Cash Incentive Plans to include a participant’s separation from service from the Company on account of death, due to disability, involuntarily for a reason other than for cause, voluntarily for good reason, due to retirement, or upon a change in control termination. If a participant experiences a separation from service with the Company due to a Qualifying Termination Event and the performance goals relating to an award for a prior performance period have been satisfied but the proceeds of such award remained undistributed, then the Company must pay such undistributed proceeds to the participant in a single lump sum, net of applicable withholding and other taxes, within two and one-half months following the participant’s separation from service and as soon as administratively practicable. These provisions in the Cash Incentive Plans are designed to provide the named executive officers and other participants in such plans with a greater degree of certainty that if the performance goals under a Cash Incentive Plan are achieved, then the participants will ultimately receive the entire amount of incentive compensation earned under the Cash Incentive Plan notwithstanding the occurrence of largely unforeseeable events over which the participants may have little or no control. Finally, the Cash Incentive Plans also provide that if, in connection with a change in control, an excise tax under Section 4999 of the Internal Revenue Code would be imposed upon a participant in connection with an award under an Incentive Plan, then the Company shall pay to the participant an additional amount (the “Excise Gross-Up Payment”) such that the net amount retained by the participant, after deduction of any excise tax and any federal, state or local income tax and any excise tax upon the Excise Gross-Up Payment, shall be equal to the amount that would have been distributable under the Cash Incentive Plan as described above but for the application of Section 4999 of the Internal Revenue Code.

The named executive officers may in the future receive equity awards granted under the Company’s 2016 Equity Incentive Plan. The related forms of restricted stock agreement provide that if a grantee’s employment with the Company (or provision of services as a non-employee director) terminates, then any unvested shares of restricted stock shall be forfeited. Notwithstanding the foregoing, such forms of restricted stock agreement provide for the acceleration of vesting of the restricted stock in the event of the grantee’s death or disability, or in the event the Company experiences a change in control. In such event, the Compensation Committee, in its sole discretion, may elect to pay the grantee’s tax gross-up payments designed to cover all income and employment taxes associated with the vesting of the restricted stock.

The named executive officers may in the future receive phantom shares granted under the Company’s Phantom Equity Plan. The related form of phantom share agreement provides that if a grantee’s employment with the Company (or provision of services as a non-employee director) terminates, then except in some specified limited circumstances any unvested shares of restricted stock shall be forfeited. Notwithstanding the foregoing, such form of phantom share agreement provides for the acceleration of vesting of the phantom shares in the event of the grantee’s termination of service without “cause” on or within 12 months following a change in control of the Company.

Director Compensation

The following table provides information concerning the compensation of each non-employee member of the Company’s Board of Directors for the year ending December 31, 2022:

DIRECTOR COMPENSATION TABLE

|

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

||||||||||||

| Brunde E. Broady | 100,000 | 29,861 | — | 129,861 | ||||||||||||

|

Yiu T. Chan |

100,000 | 29,861 | — | 129,861 | ||||||||||||

|

Randall A. Mason |

148,000 | 36,586 | — | 184,586 | ||||||||||||

| Ching C. Wong | 100,000 | 29,861 | — | 129,861 | ||||||||||||

_______________________

| (1) | The amounts in this column represent the aggregate grant date fair value of phantom shares granted to each non-employee director under the Company’s Phantom Equity Plan, as computed in accordance with FASB ASC Topic 718, Compensation – Stock Compensation, excluding estimated forfeitures. Assumptions used in the calculation of phantom share awards granted are included in Note 9 of the Notes to Consolidated Financial Statements under “Item 8. Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2022. |

During 2022, each non-employee member of our Board of Directors earned a cash retainer of $8,333 per month, plus the reimbursement of their respective out-of-pocket expenses incurred in connection with the performance of their duties as directors. Mr. Mason earned an additional retainer of $4,000 per month as Chairman of the Board of Directors in 2022.

On March 15, 2021, the Compensation Committee granted 10,370 phantom shares under the Company’s Phantom Equity Plan to each of Messrs. Chan and Wong as non-employee directors, and 13,333 phantom shares to Mr. Mason as non-employee director and Chairman of the Board of Directors. On May 14, 2021, the Compensation Committee granted 9,074 phantom shares under the Company’s Phantom Equity Plan to Ms. Broady as a non-employee director following her election to the Board of Directors on May 11, 2021. The phantom shares entitled each such non-employee director to receive a cash payment equal to the fair market value of an equal number of shares of the Company’s common stock upon the close of a vesting period, subject to a maximum payment value of $12.00 per phantom share. The phantom shares vested in eight equal three-month vesting increments, subject to the satisfaction of both a time-based vesting condition and a performance vesting condition. Both of these vesting conditions were satisfied for the first performance period in 2022, and the time-based vesting condition was satisfied for the final three performance periods in 2022. The award agreement under which the phantom shares were awarded to each non-employee director was amended for each of the final three performance periods in 2022 to provide that the performance criteria for the related vesting condition shall be deemed satisfied, as the Compensation Committee noted that the fact that the performance criteria were not achieved for the relevant performance periods was due to extraordinary business circumstances in China that were clearly beyond the Company’s control. Awards of aggregate fair value of $29,861 were made to each of Ms. Broady and Messrs. Chan and Wong, and $36,586 were made to Mr. Mason, under the Phantom Equity Plan for 2022. The phantom shares granted to Ms. Broady and Messrs. Chan, Wong and Mason in 2021 are now fully vested.

On February 6, 2023, Ms. Broady resigned as a member of the Board of Directors.

ITEM ONE

ELECTION OF DIRECTORS

Under the Company’s Bylaws, the number of directors shall not be less than three nor more than eleven, with the exact number fixed from time to time by action of the stockholders or of the Board of Directors.

Following the resignation on February 6, 2023 of Brunde E. Broady from the Board of Directors, the Nominating Committee recommended, and the Board of Directors approved, a reduction in the size of the Board of Directors to four members. The Nominating Committee is pursuing a deliberate process to identify and evaluate possible director candidates to provide a fifth board member, so it is expected that the size of the Board of Directors will subsequently be enlarged to five members upon the Nominating Committee’s recommendation, and the Board of Director’s approval, of a new director candidate.

The Company’s Board of Directors presently consists of four directors whose terms expire at the annual meeting of stockholders. The Nominating Committee has recommended, and the Board of Directors has nominated, the four director nominees identified below to stand for election at the annual meeting. Biographical summaries of the four director nominees are provided below for your information. The Board of Directors recommends that these persons be elected at the annual meeting to serve until the next annual meeting of stockholders. If, for any reason, any of the nominees shall be unable or unwilling to serve, the proxies will be voted for a substitute nominee who will be designated by the Board of Directors at the annual meeting. Stockholders may withhold authority from voting for one or more nominees by marking the appropriate boxes on the enclosed proxy card.

Biographical Summaries of Nominees for the Board of Directors

Yiu T. Chan. Mr. Chan, age 56, has been a director of the Company since December 2015. Since February 2020, Mr. Chan has served as an Executive Director of Harbour Equine Holdings Limited (formerly Shen You Holdings Ltd.) (SEHK: 8377), and from July 2016 to August 2022 Mr. Chan also served as Corporate Secretary of Harbor Equine Holdings Limited. Harbour Equine Holdings Limited is an investment holding company. Mr. Chan served as a self-employed business and tax advisor from December 2015 to February 2020. Mr. Chan served as a Partner in Grant Thornton’s Tax and Business Advisory group in Guangzhou, China from October 2012 to October 2015, and from 2002 to 2011 served in several senior positions with both Ernst & Young (including Tax Director and Partner from June 2006 to December 2011) and PricewaterhouseCoopers, also located in Guangzhou, China. Mr. Chan served as Director of Investment and Planning from July to September 2012 for Blue Ocean Corporation Limited, which provides business and tax advisory services to foreign companies investing in China and Chinese companies investing overseas.

Mr. Chan has extensive experience in advising companies operating in China, helping to navigate complicated tax and business compliance matters. Mr. Chan holds a bachelor degree in accounting from City University of Hong Kong and is a member of both the Hong Kong Institute of Certified Public Accountants and Association of Chartered Certified Accountants.

Ching C. Wong. Dr. Wong, age 64, has been a director of the Company since June 2020 and served as a consultant to the Company from 2016 until immediately prior to his election as a director of the Company. He was also an employee of the Company from 2004 to 2007 and 2009 to 2010. Dr. Wong served as Corporate Controller from 2000 to 2004 for North Pole Limited, a Hong Kong-based manufacturing and trading company of outdoor consumer goods and also held several senior Asia regional positions for two US publicly-held companies. Dr. Wong obtained a PhD in Marketing Management from Shanghai University of Finance and Economics (SUFE) in 2011 and a law degree from Tsinghua University, Beijing in 2006. Dr. Wong is a current fellow member of the Association of Chartered Certified Accountants, UK.

Dr. Wong has been a life-long entrepreneur and businessperson, active in Greater China, which is our most important market. He has extensive experience in business practices, culture and protocol, particularly those of Hong Kong and China.

Chris T. Sharng. The biographical information for Mr. Sharng, the Company’s President, is set forth above under the caption “Information About Executive Officers.” As the Company’s President since 2007, and as the Chief Financial Officer prior to that, Mr. Sharng has developed a deep understanding of our business globally. His leadership has been integral to our success.

The Board of Directors recommends that stockholders vote “FOR” each of the persons nominated by the Board of Directors. Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted FOR the election of the above listed nominees and AGAINST any other nominees.

ITEM TWO

RATIFICATION OF THE APPOINTMENT OF MARCUM LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2023

The Audit Committee has appointed Marcum LLP (“Marcum”) as the Company’s independent registered public accounting firm to perform an audit of its consolidated financial statements for fiscal year ending December 31, 2023.

The Audit Committee is directly responsible for the appointment and retention of the Company’s independent registered public accounting firm. Ratification by stockholders of the appointment of Marcum is an advisory matter that is not binding on the Company because it is not required by the Company’s organizational documents or applicable law. Nevertheless, the Audit Committee has determined that requesting ratification by stockholders of its appointment of Marcum as the Company’s independent registered public accounting firm is a matter of good corporate practice. If the Company’s stockholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain Marcum, but may still determine to retain them. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

Audit and Other Professional Fees

During the fiscal years ended December 31, 2022 and 2021, approximate fees billed or accrued to the Company for services provided by Marcum were as follows:

Audit Fees. Fees for the audit of our annual financial statements and the reviews of our quarterly financial statements totaled $305,000 and $263,000 for 2022 and 2021, respectively.

Audit-Related Fees. No audit-related services were rendered during 2022 or 2021.

Tax Fees. No tax services were rendered during 2022 or 2021.

All Other Fees. No services other than those related to audit fees, audit-related fees or tax fees stated above were rendered during 2022 or 2021.

Pre-Approval Policies and Procedures for Audit and Non-Audit Services

The policy of the Company’s Audit Committee is to pre-approve all audit and permissible non-audit services to be performed by the Company’s independent registered public accounting firm during the fiscal year. Before engaging an independent registered public accountant firm to render audit or non-audit services, the engagement is approved by the Company’s Audit Committee or the engagement to render services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee.